The U.S. stock market experienced its largest single-day drop in nearly 2 years

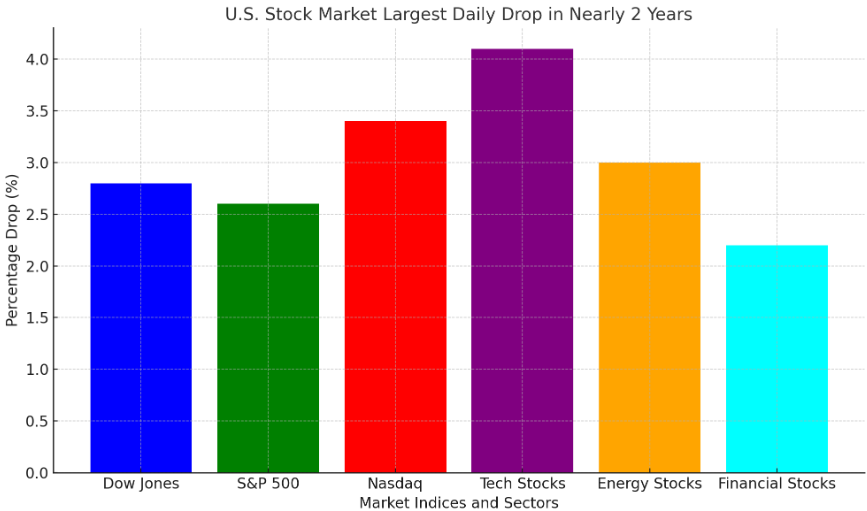

The U.S. stock market experienced its largest single-day drop in nearly two years, marking a unstable day for investors. Major indices, such as the Nasdaq Composite, the S&P 500, and the Dow Jones Industrial Average, witnessed notable decreases on Tuesday as investor concerns about inflation, increasing interest rates, and the overall economic outlook intensified.

Sector Performance

The majority of sectors saw losses during the widespread decline. Particularly badly impacted were tech companies, which during the post-pandemic boom had been the market’s darlings. As growth-oriented companies were negatively impacted by rising interest rates, industry titans such as Apple, Microsoft, and Tesla all saw sharp reductions. In addition, as worries about worldwide demand and a possible economic downturn impacted on the industry, energy stocks—which had profited from rising oil prices in previous months—also declined.

Major banks like JPMorgan Chase and Goldman Sachs lost ground as worries about slowing economic growth started to damage their earnings projections, which also had an impact on financial stocks. Declines in the real estate industry also reflected investor concerns about the home market in an environment where interest rates are high.

Key Factors Behind the Drop

Interest rates are being raised by the Federal Reserve in an attempt to control inflation, even though recent economic data indicates that prices are still growing across a number of industries, most notably housing and energy. High living expenses are the cause of the fall in consumer confidence and worries that the economy may slow down.

The aggressive approach to interest rate policy taken by the Federal Reserve is another factor contributing to this drop. Investors are becoming more and more concerned that the Fed’s plan would trigger a recession. Higher borrowing costs are already being felt by businesses in terms of their profitability and consumer spending, which is a major factor in economic expansion.

Market Sentiment

The latest round of economic data continues to offer a mixed picture, which has made investors more cautious in attitude. The factory production and retail sales are two indicators that are beginning to show signs of deterioration, even if the labor market is still solid. This contradiction is the source of the market’s volatility, which has alarmed investors.

Rising dangers from inflation, rising interest rates, and problems with the global economy made the future of the US stock market difficult. Traders will be keenly watching the Federal Reserve’s sessions in the weeks to come, as well as the publication of economic data and business profit reports, in an effort to accurately predict the next phase of the market.